A recent report from Argus Insights says that consumer demand for DIY connected home products, epitomised by the Nest thermostat, but also including wireless security cameras and lighting control systems, dropped dramatically in the first half of 2015. But that doesn’t mean that the promise of the smart home is dead – it just hasn’t arrived yet.

Argus made its home automation assessment not from random surveys or focus group questionnaires, but by monitoring consumer touchpoints such as user product reviews (on sites like Amazon) and social media mentions of key technologies.

“We have used our matrix to beat Wall Street estimates of things like iPhone sales every quarter for the past four years,” says John Feland, CEO of founder of Argus Insights.

“I still think it (smart home) is going to be huge. What we’re seeing right now is a market in stagnation.”

Argus reports that by May 2015, interest in connected home products was 15 percent lower than where it was the same time last year, despite there being significantly more connected home products on the market and correspondingly more information about the technology available.

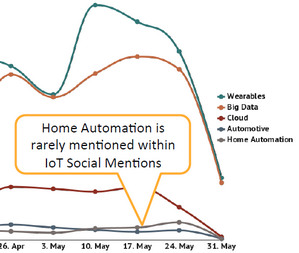

John also suggests that wearables, such as activity trackers like Fitbit, have replaced the ‘connected home’ in most Internet of Things (IoT) interest.

“For a long time smart home has either been the domain of the (DIY) enthusiasts or the folks with high income who can afford to have someone else come in and do it for them,” says John.

“In order for it to move to the mainstream (consumer) it has to get to the point where people can do it for themselves and it makes sense enough that they want to.”

Early adopter tech enthusiasts, he says, drove a lot of the excitement (thanks in part to a host of successful Kickstarter campaigns), but now mainstream consumers are finding that the reality of configuring and maintaining a smart home system is more work than they bargained for.

Essentially, the market is running out of early adopters.

A lot of the early enthusiasm was more over the novelty of the products than their practical use.

Philips Hue lights are a good example of that, according to John.

“Novelty drives the first surge; utility drives the second,” says John.

The big buzz last year was over security cameras, he says.

Dropcam was huge and made even more news when it was acquired by Nest Labs, which had previously been acquired by Google. (The recent Nest camera has been more coolly received.)

A few successful Kickstarter launches, such as the Canary and Piper security cameras also attracted a lot of attention to the market, resulting in even more new product introductions. But the optimism of 2014 is turning into the reality of 2015 as that market has dropped, due partly to connectivity and usability issues, according to John.

He says that people purchase products that help them tell a story or fulfil a vision of themselves.

The smart home slowdown is, in part, due to the fact that people ‘no longer believe that the story is going to come true for them’.

In other words, they don’t believe in the promise of the smart home.

Leading what he sees as the broken promises of the smart home, are issues of installation and setup.

Every manufacturer claims its products can be set up in minutes and be completely intuitive. The truth is that many are not.

“Nest sells itself as something you can install yourself, yet a lot of people have to have it installed for them,” John says.

He suggests that network issues cause a lot of installation problems, largely because home networks are often not robust enough (or secure enough) to support all the new chores now being assigned to them.

The laundry list of incompatible wireless protocols is another deterrent.

“As an industry, we have to make all this light-switch-simple. We’re running out of folks who have the interest (or skills) to be early adopters,” John says.

“What makes the early adopter happy doesn’t necessarily work for the rest of the market.”

On the other hand, John notes that when things don’t work, ‘people don’t want to pay for professional help. It’s hard to win in that situation’.

Many of the retailers selling smart home products in the US, such as Lowe’s, Staples or Best Buy, don’t offer a very comprehensive guided sales experience.

That can result in consumers coming home with the wrong products for their project.

John says: “To take the collective intelligence of all those (professional installers) and try to distil it into something that consumers can understand and do themselves… there are still too many pieces that haven’t been designed.”

A Shift Toward Other Control Devices?

While the initial mad dash seems to be over, John doesn’t think this spells doom for the DIY smart home market.

“It’s recoverable. It’s going to take someone to take a leadership role and make this light-switch simple,” he says.

Does this spell a good opportunity for Apple and its HomeKit system? Considering the rocky semi-rollout of HomeKit, it’s still too early to tell in John’s book.

Another research firm, IHS, sees strong growth for connected products in the future, just not products that we generally think of as part of the smart home.

The big growth, says IHS, will be in white goods, or major household appliances.

That firm’s research predicts that the compound annual growth rate (CAGR) for connected appliances will increase 134 percent over the next five years.

“The promise of the smart home is tremendous,” says John, and the ability to control devices with apps and set up simple scenes exists now in DIY products.

However, “no one has done that part of how to integrate this piece with that piece in a way that makes sense,” he says.

More Research

Consumer Awareness Of IoT Still Low As Apple Named Top Brand

Apple Watch Fails To Sell; Parts Supplier Falls Short Of Breaking Even