Members of the Clarity Alliance or Retra will soon be able to sign up for free Google crash-courses held at the search provider’s swanky London HQ.

Both Clarity Alliance and Retra members will be able to take advantage of the free courses which will focus on four key aspects: Analytics, Video and Display Advertising, Search and Cooperative Advertising.

Aimed at those at marketing director level or above, the free courses will take place in either March/April, May, September and November. Around 50/60 places will be available on each course with those wishing to attend being given a place on a first come first serve basis.

Those interested in taking a space on one of the courses are encouraged to contact Phil Hansen of Clarity Alliance. Each session will last one and a half hours.

The free course announcement was made at the annual Clarity Alliance conference, where the organisation had a variety of speakers discussing the current state of the audio industry.

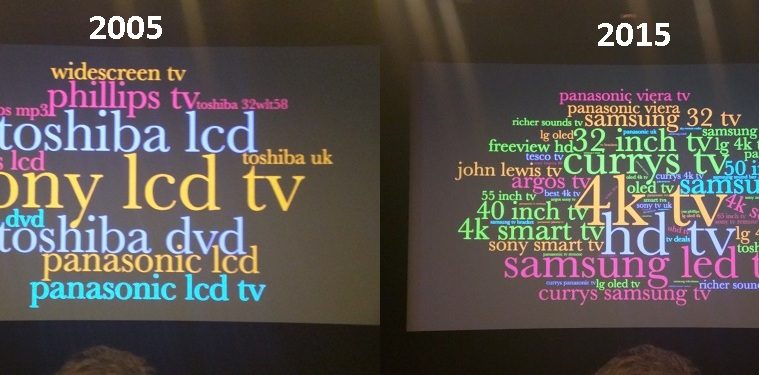

Richard Hartigan, Google’s industry manager, Technology, gave an in-depth speech about the paradox of choice and the difficulties facing many consumers with so many products on the shelves.

According to research, consumers are left with 6.5m choices when they want to buy a new living room set-up. That includes everything from an audio system to a TV and brackets and racking.

With such a huge number of different products to choose from, consumers are forced into a longer buying cycle, with many remaining indecisive for well over a month.

There’s also the battle for shelf space; which Richard noted has led to the rise of companies going directly to consumers. OnePlus, the relatively unknown smartphone manufacturer until recent years, is one such example of how this strategy could be successful.

Despite the rise of online retail however, Google’s data sees it suffering from the consumer demand for more information however. One industry seeing this trend is travel, where the travel agent is seeing a resurgence, despite the plethora of online booking services available.

Consumers however are finding other ways to be consulted online. When searching for products, 15% of those searches are on YouTube; a massive captive audience for advertisers and manufacturers. The consumers are also searching other areas, including reviews and news about products.

That means when the customer goes into store, they already have two or three products in mind. And when they go into that store, Google now has the capability to track which customers saw a product online and then went into store – thanks to geolocation technology in Android and Chrome. The company hopes to improve that technology to track sales as well.

According to Google’s research, 80% of consumers research a product online, while only 30% purchase online.

Nick Simon from GFK also had some rather interesting research about the industry as a whole.

According to Nick, in 2015 consumer confidence hit its highest level in almost 13 years, while oil price dropped to an 11-year low. Wage growth also continued to outstrip inflation.

Despite those positives, the Eurozone’s growth slowed to 0.3% in Q3, while the IMF cut the US and global growth forecasts, especially among emerging markets. China also saw its slowest growth in 25 years.

In Europe very few countries saw signs of growth in 2015 vs 2014. TVs tend to show growth in years where the world cup is held, which could explain the decline. The market could see growth in 2016 however, as the European championships and Olympics are likely to have a knock-on effect on sales.

The UK is also not a market being affected by the slowdown as much as some of its European neighbours, including France and Russia. Sweden and Ireland are showing signs of growth however, proving that not all is doom and gloom in the AV world

In the UK the durable goods market saw a slight increase in revenue in 2015, with a 0.5% uptick. TVs and turntables saw a slight decline of 0.6% however.

The products suffering in the marketplace include TVs below 43in, Hi-Fi components, home theatre systems and portable media players. In fact, 2015 is forecast to be the last year where sales of PMPs is over a million.

Despite the slowdown on growth on those products, TVs larger than 43in, turntables, soundbars, UltraHD products and multi-room audio systems all saw significant growth in the marketplace.

Just looking at Audio however, there is a fast pace of growth almost across the board. UK growth at 6.6%, while Irish growth is 24.6%.

Headphones, wireless speakers, soundbars, turntables and connected audio systems are all seeing huge growth. Turntables are up 107.1%, while connected AHS grew 75.6%. Soundbars are also seeing huge growth, with over a million sold in the UK in 2015.

Not all good news however, as clock radios, home theatres, PMPs, portable radios, traditional AHS and receivers all shrank in 2015. PMPs were down 23.2%, while receivers shrunk 14.9%.

Despite new categories dominating the limelight in the world of consumer electronics, including the smart home and the Internet of Things, as a percentage of UK consumer electronics revenue, audio actually grew from 12.6% in 2014 to 15.2% in 2015.

Soundbar represented the biggest chunk of sales in the UK in 2016, with 66% of the market comprising of Bluetooth speakers, connected AHS, network music systems and soundbars.

Connectivity is also important in the audio marketplace, with 150m connected devices sold in the last five years. 31m were sold in 2015 alone. That includes products like Sonos and Denon Heos. Smart audio unit sales grew 29% in 2015 and 33% in terms of revenue.

Soundbar unit sales grew 25% in 2015, revenue 18%. Six years ago soundbars accounted for just 9% of revenue compared to home theatre which was 91%. Now soundbar is 92%, compared to home theatre which stands at 8%. Soundbars with subs account 2/3 of the category’s revenue.

NMS unit sales grew 4% but revenue grew 25%. Bluetooth speaker unit sales also grew, by 19%, but revenue only grew 13%.

The growth of all those products have nothing on the rise of the turntable however. Turntables accounted for 58% of record players in 2015. They grew 98% in terms of unit sales, from 94,000 to 186,000. Choice is also rife, 44 brands now sell turntables, with 168 models available. 63% of record player turnover came from turntables.

The growth of the turntable can also be seen in the UK music market. Physical audio sales shrank only 0.5% in 2015, with vinyl up 65% to its highest level in 21 years. CDs also had the smallest decline it has had in almost a decade, at 3.7%.

Receivers saw the toughest year however, but according to GFK’s research there’s still evidence of strength of premium priced products. In total receivers are down 11% in terms of units, 9% in value. 16% of revenue came from receivers priced above £1,000 however.

Amplifiers and CD players also dropped. 3% decline apiece in terms of units. Amps and CD players over £1000 still account for over 20% of market however.

Loudspeakers excluding soundbar down 7% in terms of units, but revenue stayed the same. That’s thanks to speakers above £1,000, which now account for 25% of the revenue, compared to 20% in 2014.