TiVo’s UK video trends report finds 84% of viewers scroll aimlessly as streaming services multiply. TiVo says almost half of U.K. consumers take advantage of free AVOD/FAST services, becoming a primary means for video entertainment.

TiVo, a wholly owned subsidiary of entertainment technology company of Xperi Inc. (NYSE: XPER), has found that users are overwhelmed by the rising amount of video providers, adding to increased viewer irritation when deciding what to watch. According to the latest 2024 TiVo Video Trends Report: U.K. only 16% of viewers know what they want to watch when they start browsing, resulting in ‘habit browsing’ for the majority of viewers.

With more streaming providers making their way to the U.K. entertainment market and fueling an upwards tick in consumption, the report also found that the average number of services used by U.K. viewers has increased from 6.0 in Q2 2023 to 6.5 in Q2 2024. Furthermore, 61% of viewers say they switch between more than one app in a typical viewing session, increasing from 55% in Q2 2023, meaning less time enjoying entertainment they love, and more time spent browsing for the next show or movie.

Deep dive

Delving deeper, the report finds a lack of personalised recommendations is also driving ‘habit browsing.’ Nearly one-fifth of viewers (19%) say they struggle to find something to watch when they don’t have anything specific in mind and 18% admit to starting, stopping and selecting something else many times during a viewing session. The variety of options and content quality is also having a significant influence on consumer loyalty, as content providers battle for subscribers, with 34% of current streaming service users saying they want to cancel their subscription video on demand (SVOD) (e.g., Netflix, Prime Video) within the next six months.

“As streaming options multiply, viewers are facing continued frustration when it comes to finding something to watch, showing ongoing discontent with the difficulty of finding material that suits their personal preferences,” says Gabriel Cosgrave,general manager of EMEA at Xperi. “TV manufacturers need to prioritise key smart TV features such as aggregated and unbiased content offerings, and user experience features like hyper-personalisation and natural voice search so that consumers find content they love quickly.”

Additional TiVo Video Trend Report statistics:

- U.K. viewing time increases: TV viewing shows no signs of slowing. In fact, daily viewing time rose to 3.8 hours per day, increasing to 4.0 hours for respondents with children in their home and 4.2 hours for viewers in Scotland.

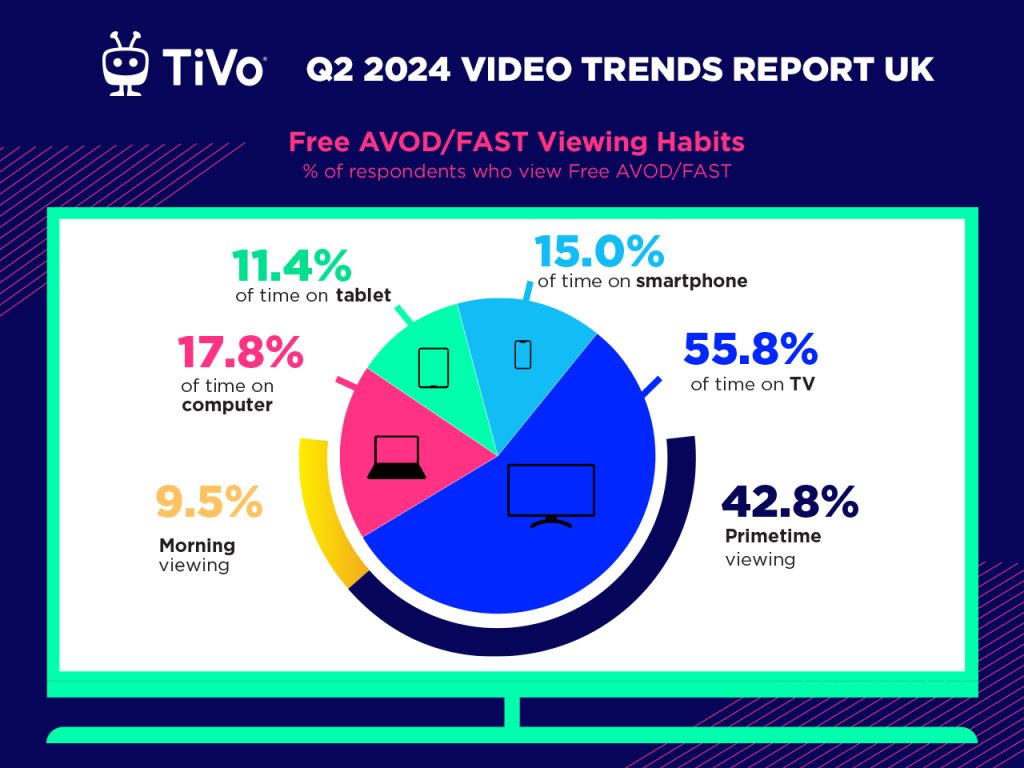

- AVOD/FAST adoption is growing steadily: 43% of respondents use free AVOD/FAST services (e.g., FreeVee, Pluto TV), pointing to an increased desire for free content and a high ad tolerance across multiple devices (56% view on TV, 18% on a computer, 15% on a smartphone).

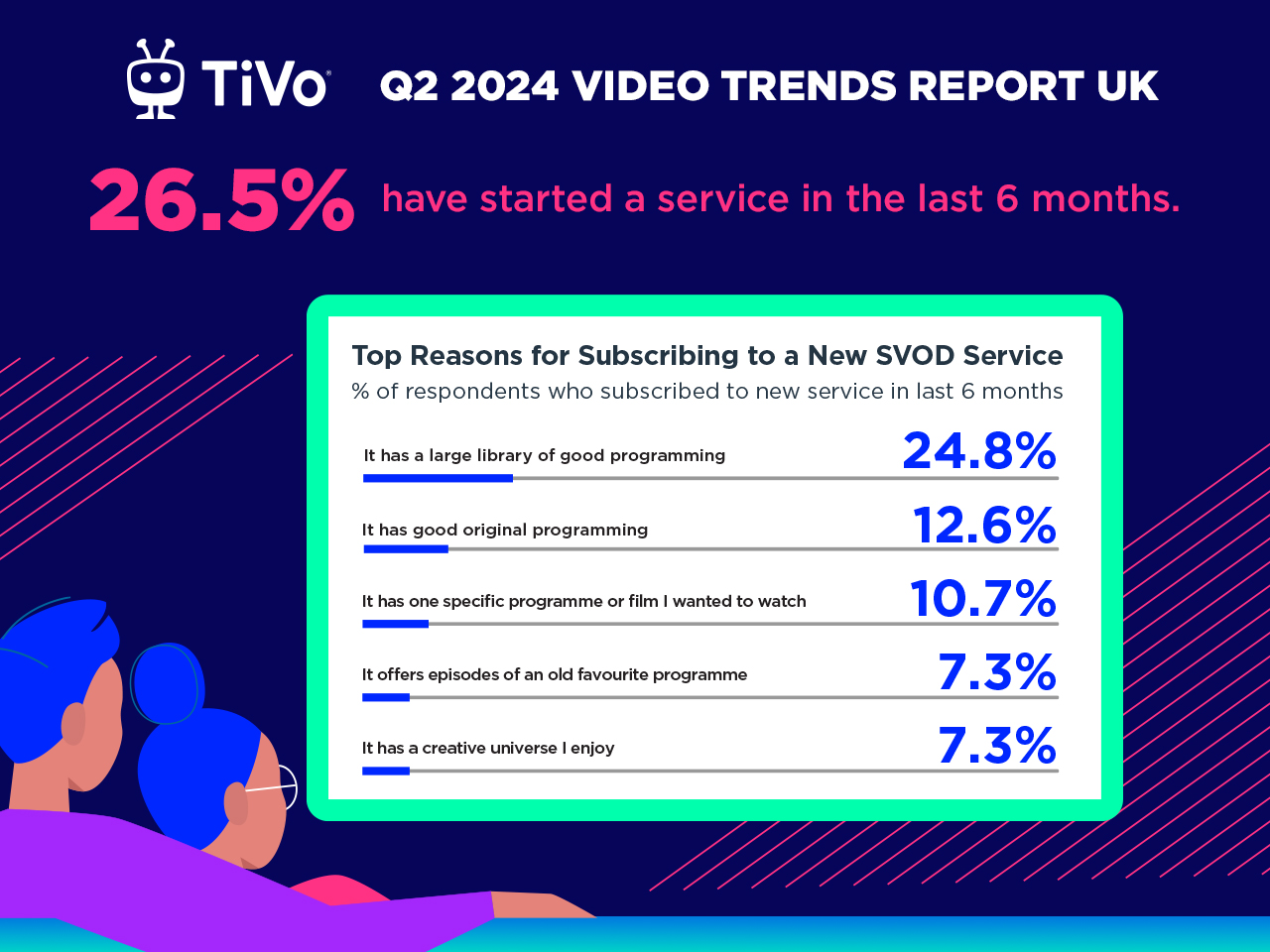

- Churn and growth: 27% of U.K. consumers have started using a new service in the last six months, but 21% have cancelled a service during the same period, highlighting the competitive pressures facing service providers.

- The rise of watching social content on TV: Over one-third of respondents watch social video content on a TV at least several times a week, an increase of almost 9% since spring 2023 – showing the continued appeal of social video content on a larger screen.

Find more information from the 2024 Video Trends Report: U.K. visit here.